Banking While Muslim: From closed accounts and denied transactions to investigations, Muslims are the most likely faith group to report challenges with financial institutions

March 14, 2023 | BY YOUSSEF CHOUHOUD

Scholars, commentators, and activists have written volumes on the discrimination leveled against Muslims in America, especially over the past two decades. Notably, these experiences are not relegated to the history books. From the ongoing bullying of school-age children, to the sustained high levels of discrimination reported, to the seemingly endless cache of statistical anomalies that power the “random” searches in airports of those who identify as Muslim (as well as those who are mistaken to be Muslim), discrimination is on-going and ever-present. What is more, the social and political environment in the US can periodically create the conditions for new–or renewed–difficulties for this community.

In recent years, Muslim individuals, businesses, and nonprofits have reported facing potentially discriminatory practices at some of the nation’s largest banks. During this time, the Council on American Islamic Relations (CAIR) New York chapter has advocated on behalf of clients alleging disparate treatment when opening or maintaining a bank account. Rather than a local problem, these experiences can be found in different regions across the country. A growing sense that such incidents are not isolated has pushed a group of lawmakers to urge financial institutions to “modernize” policies that implicitly discriminate based on ethnic and religious background. Against this backdrop, there is a need to move beyond anecdotal accounts and study the issue systematically.

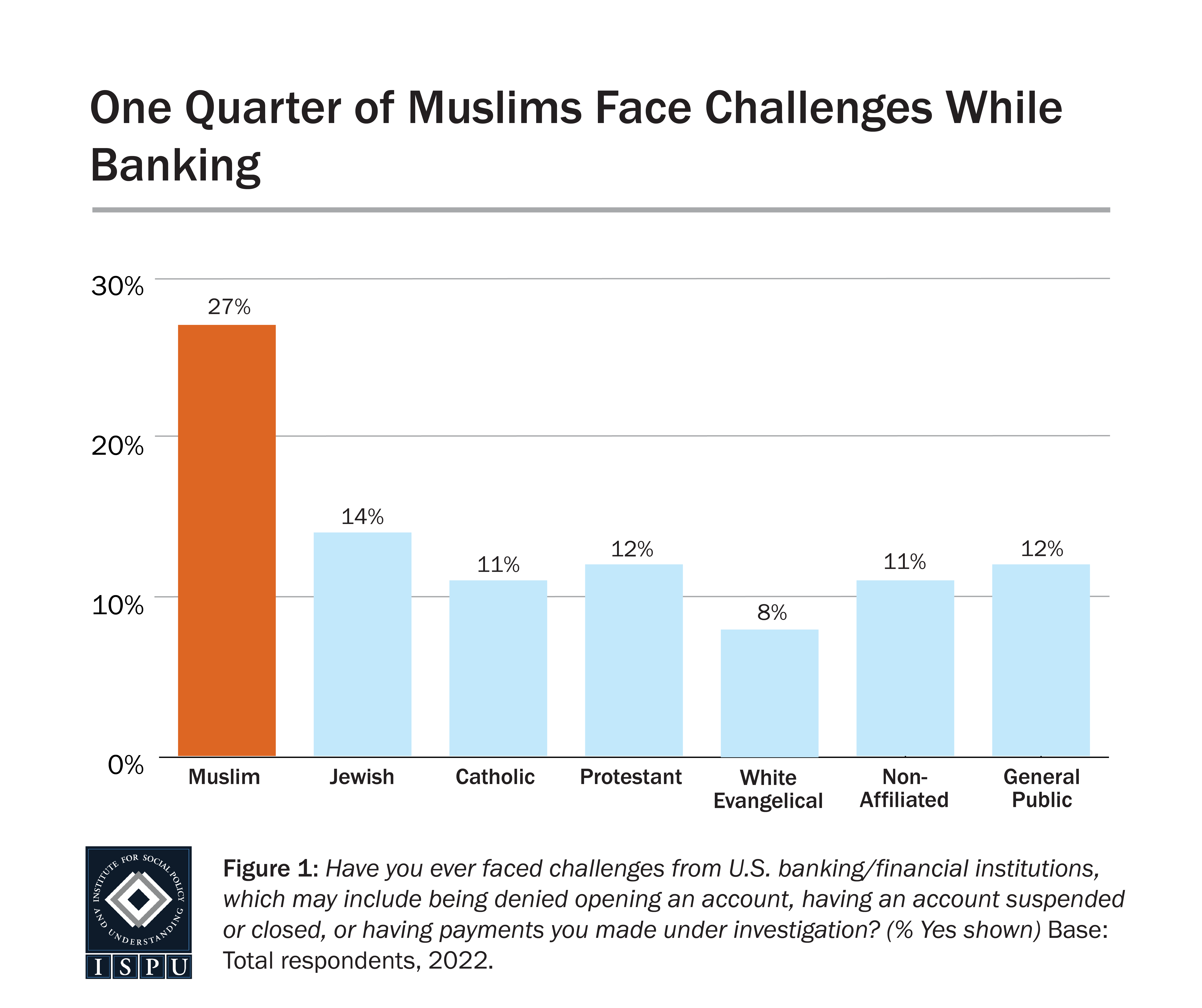

Muslims Are the Most Likely Faith Group to Report Facing Challenges While Banking

In its 2022 American Muslim Poll, ISPU sought to gain an empirically grounded sense of the “banking while Muslim” phenomenon. Members of the general public, alongside representative Muslim and Jewish oversamples, were asked whether they ever experienced challenges working with US banking and financial institutions. Challenges may include (but are not limited to): being denied opening an account, having an account suspended or closed, or having payments you made under investigation. We found that Muslims are significantly more likely than all other groups surveyed to report such difficulties. Whereas the proportion of the general public and Jews that have had these experiences are similar (12% vs. 14%, respectively), Muslims are about twice as likely to report challenges at financial institutions, at 27%. This is on par with Black Americans overall, which is discussed in more detail below.

Banking While Muslim

X 00, 2023 | BY YOUSSEF CHOUHOUD

Scholars, commentators, and activists have written volumes on the discrimination leveled against Muslims in America, especially over the past two decades. Notably, these experiences are not relegated to the history books. From the ongoing bullying of school-age children, to the sustained high levels of discrimination reported, to the seemingly endless cache of statistical anomalies that power the “random” searches in airports of those who identify as Muslim (as well as those who are mistaken to be Muslim), discrimination is on-going and ever-present. What is more, the social and political environment in the US can periodically create the conditions for new–or renewed–difficulties for this community.

In recent years, Muslim individuals, businesses, and nonprofits have reported facing potentially discriminatory practices at some of the nation’s largest banks. During this time, the Council on American Islamic Relations (CAIR) New York chapter has advocated on behalf of clients alleging disparate treatment when opening or maintaining a bank account. Rather than a local problem, these experiences can be found in different regions across the country. A growing sense that such incidents are not isolated has pushed a group of lawmakers to urge financial institutions to “modernize” policies that implicitly discriminate based on ethnic and religious background. Against this backdrop, there is a need to move beyond anecdotal accounts and study the issue systematically.

Muslims Are the Most Likely Faith Group to Report Facing Challenges While Banking

In its 2022 American Muslim Poll, ISPU sought to gain an empirically grounded sense of the “banking while Muslim” phenomenon. Members of the general public, alongside representative Muslim and Jewish oversamples, were asked whether they ever experienced challenges working with US banking and financial institutions. Challenges may include (but are not limited to): being denied opening an account, having an account suspended or closed, or having payments you made under investigation. We found that Muslims are significantly more likely than all other groups surveyed to report such difficulties. Whereas the proportion of the general public and Jews that have had these experiences are similar (12% vs. 14%, respectively), Muslims are about twice as likely to report challenges at financial institutions, at 27%. This is on par with Black Americans overall, which is discussed in more detail below.

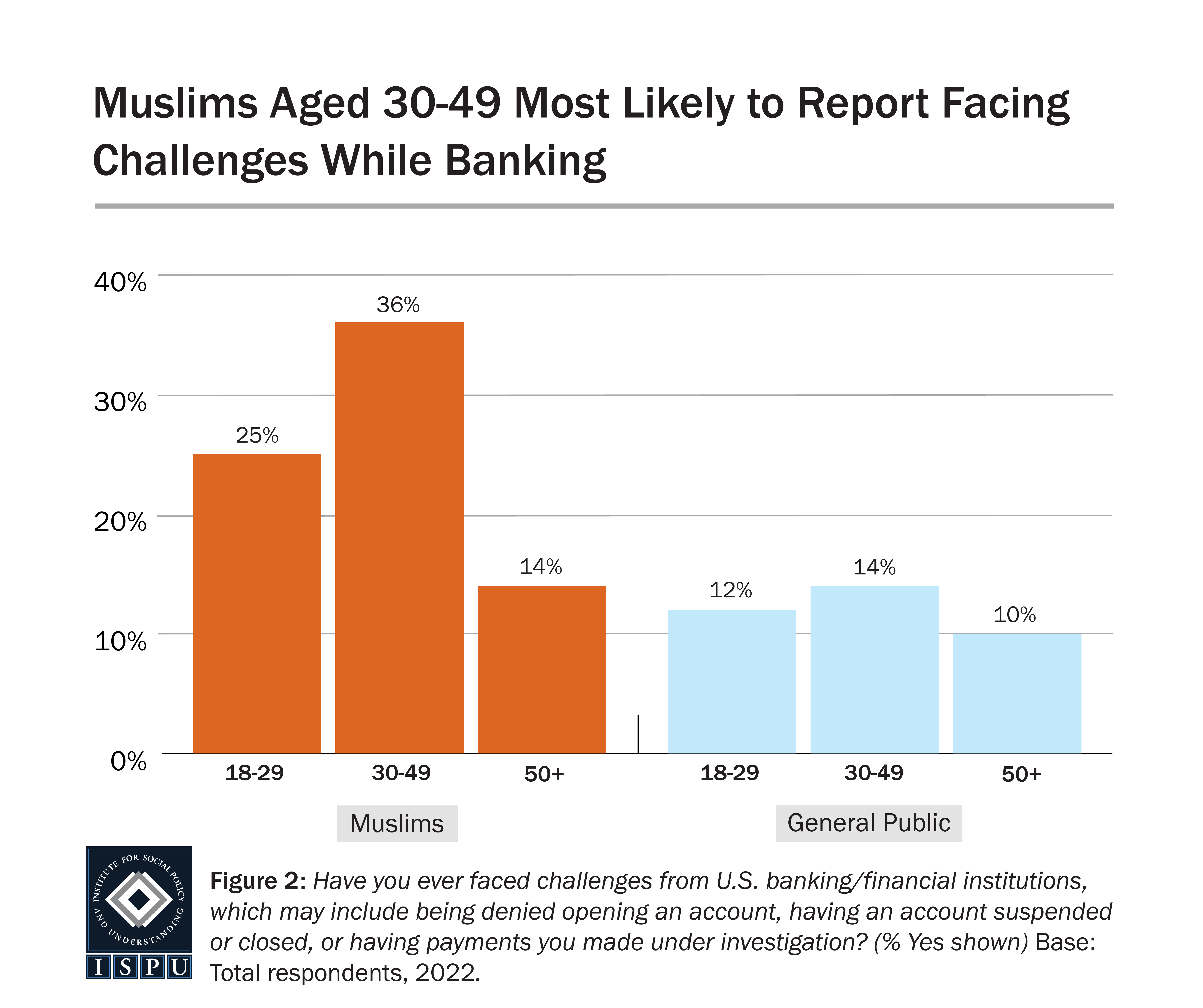

Taking a closer look at the Muslim sample, there are some notable demographic divides. Muslims aged 50 and over are the least likely to report facing challenges while banking, at 14%, while the youngest adults, age 18-29, report a significantly higher rate of 25%. The most likely age group to report facing difficulties while transacting, however, are 30-49 year olds, at 36%. It is rather remarkable that one in three Muslims in this age group has experienced difficulties when dealing with financial institutions and is especially concerning as this is the cohort that is most likely to start businesses, purchase homes, and otherwise hold the disposable income that propels US commerce. This pattern is not replicated among the general public, who evidence no statistically significant differences on the basis of age, with a low of 10% among those 50 and older, to a high of 14% among 30-49 year olds (with 18-29 year olds splitting the difference at 12%).

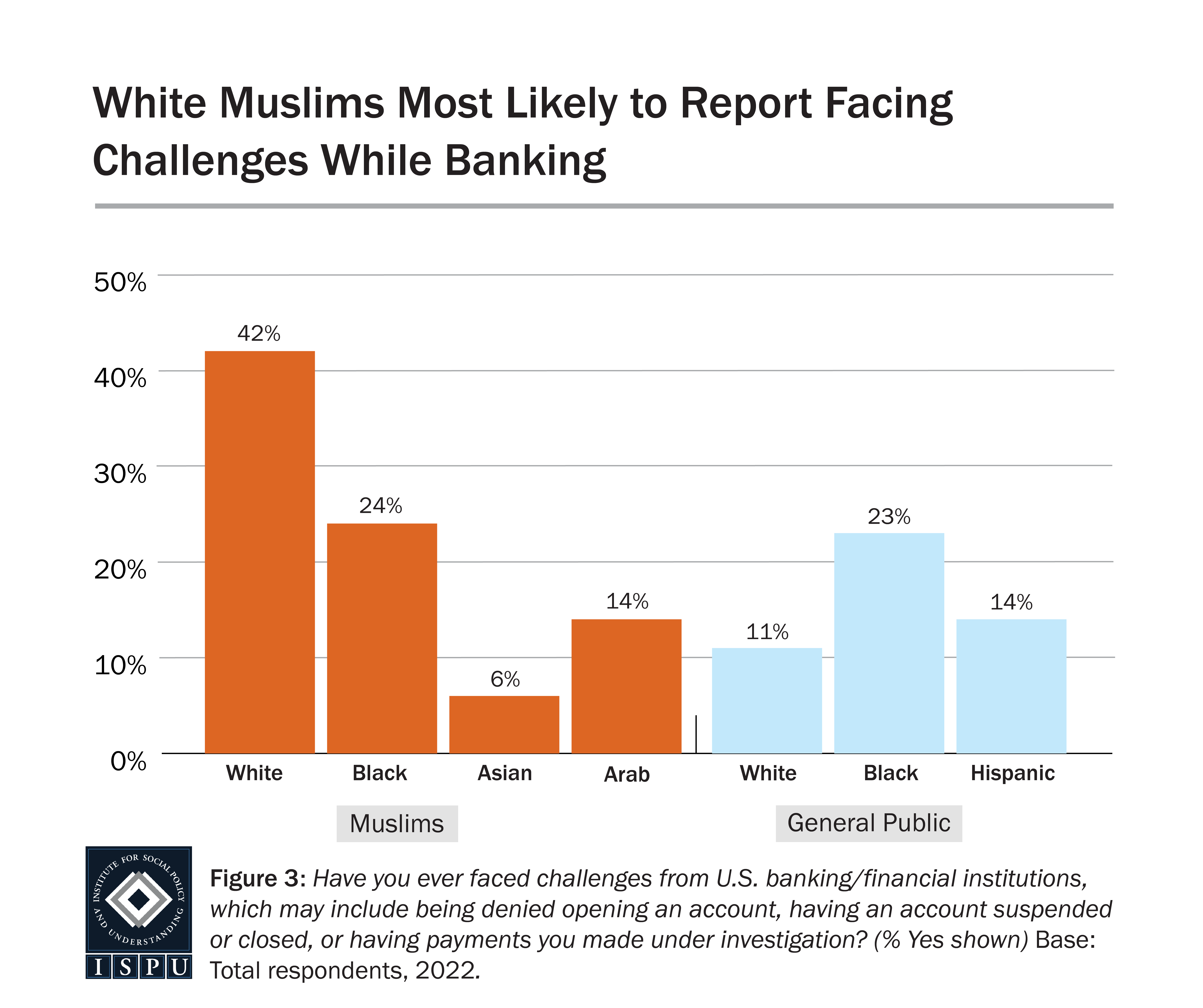

Examining the data on Muslims broken down by race/ethnicity yields a somewhat perplexing picture. Only about 6% of Asian Muslims report facing challenges while banking, which is statistically on par with Arab Muslims (14%). Unsurprisingly, given the compounded discrimination they face, Black Muslims tend to report such difficulties at a significantly higher rate (24%). However, far and away the group that is most likely to report burdensome experiences at financial institutions is white Muslims, at 42%. This finding is not entirely unexpected, as we found that Muslims who identify as white are more likely than other racial/ethnic groups to report religious discrimination on a regular basis. Still, such a result does run counter to the typical link between experiencing discrimination in America and identifying as a racial/ethnic minority. This distinct dynamic highlights that there is still much to learn both with regards to the racialization of Muslims and their experiences across core institutional settings–banks being but one such space.

When comparing proportions of racial groups facing banking challenges by race, we find that about one-fourth of Black Muslims (24%) and Black Americans in the general public (23%) experienced these challenges, while white Muslims (42%) were much more likely than white Americans in the general public (11%) to report facing challenges with financial institutions. Moreover, Black Americans in the general public are more likely than white Americans in the general public to face banking challenges (23% vs. 11%). Fourteen percent of Hispanic Americans in the general public reported facing such challenges¹.

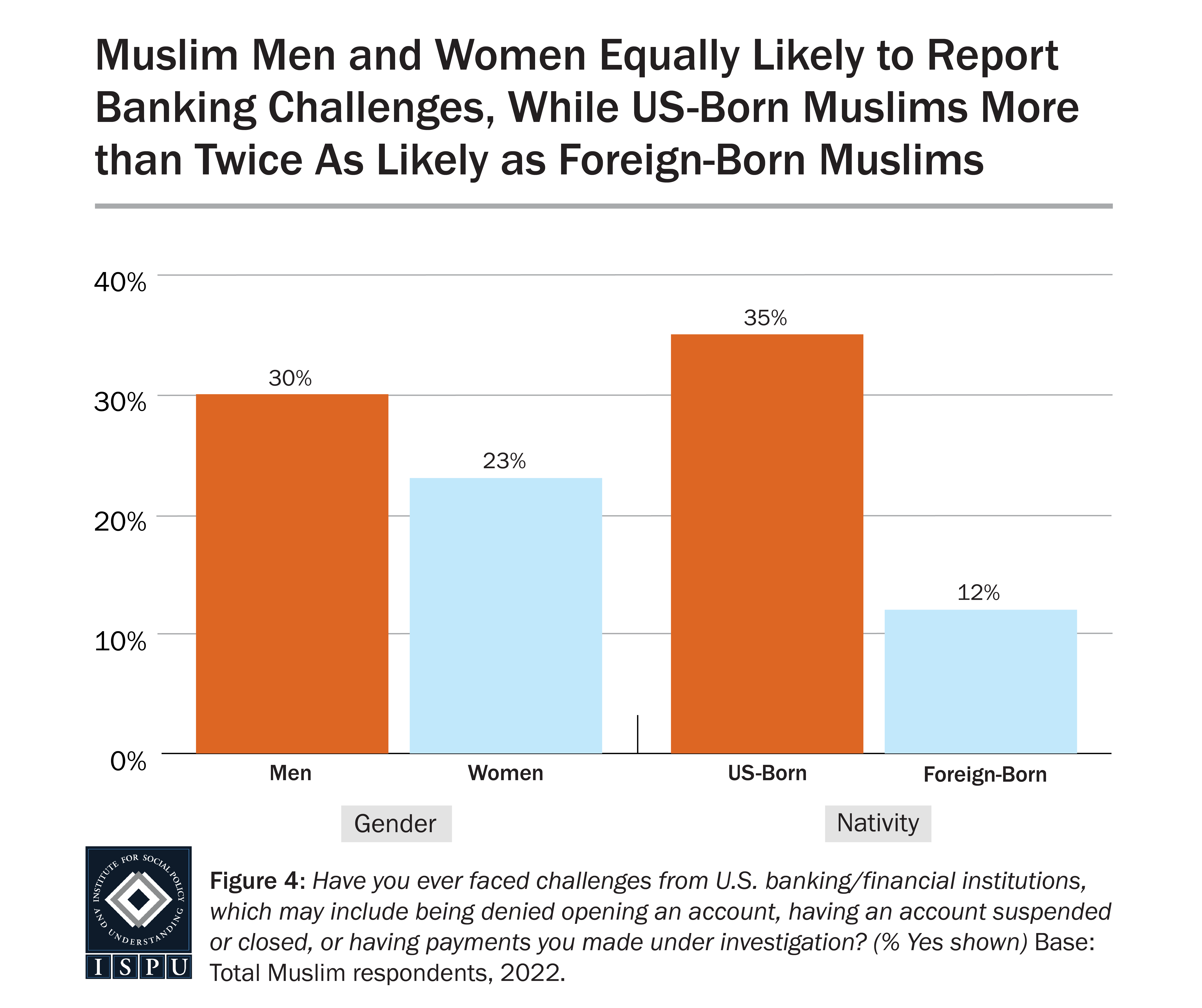

A final set of demographic categories highlights both experiential parity and disparity. In the first instance, although Muslim men and women report difficulties while banking at nominally different rates (30% vs. 23%, respectively), this divide is statistically insignificant. Conversely, comparing US-born and foreign-born Muslims evidences one of the widest gulfs in this analysis. Muslims born in America are nearly three times as likely as those born abroad to report facing obstacles while banking (35% vs. 12%, respectively). This finding accords with a previous analysis we did on the role nativity plays in conditioning American Muslims’ attitudes and behaviors. Drawing on the takeaways from that research, the divide we see in this analysis could be the result of native-born Muslims putting themselves in the kinds of circumstances that would lead them to report higher rate of difficulties while banking, or it could be that this group is simply more likely to identify certain interactions as outside the norm. At this point, it is hard to say whether this finding underscores an experiential or a perceptual difference.

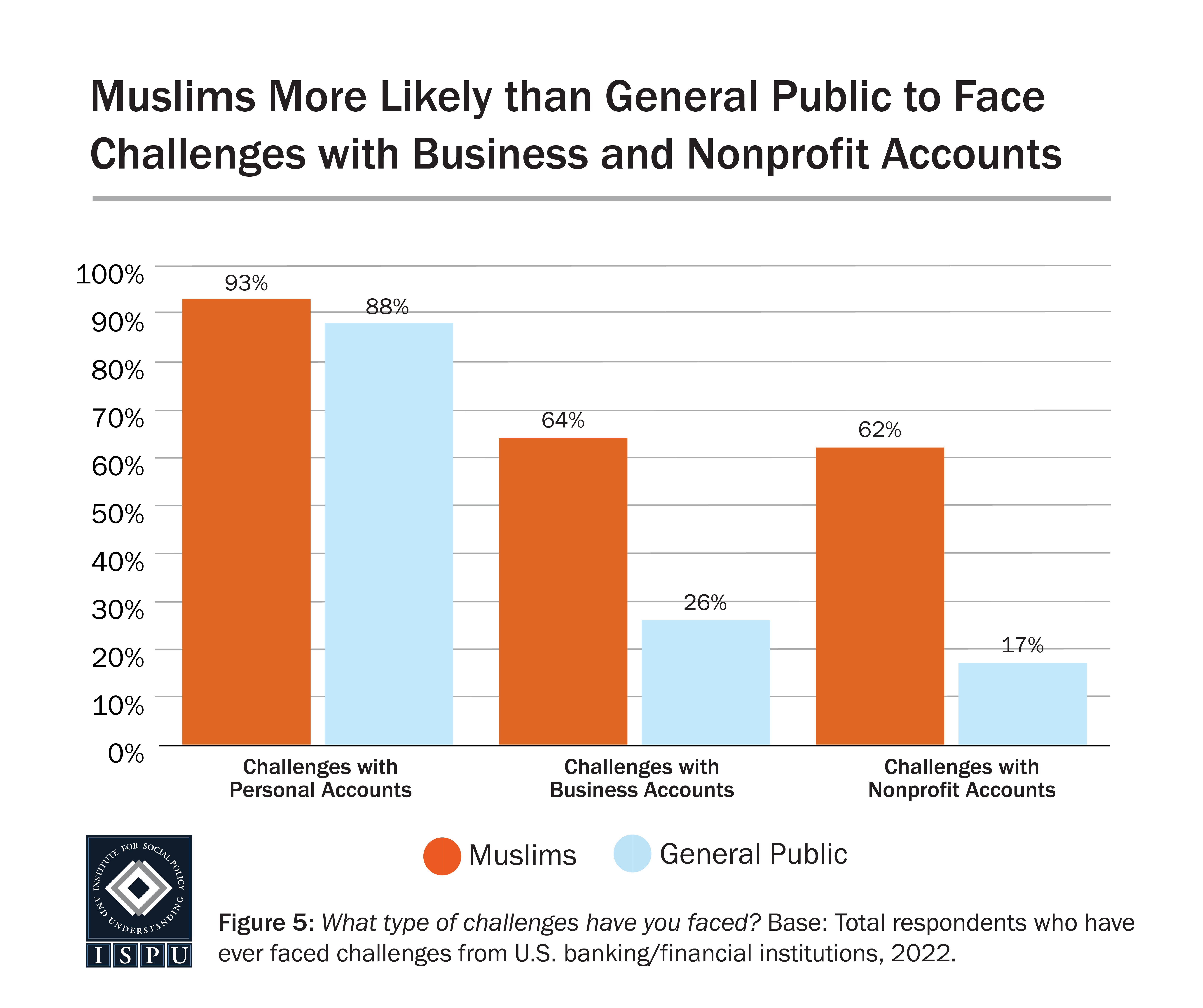

Muslims Face Challenges Across Personal, Business, and Nonprofit Accounts

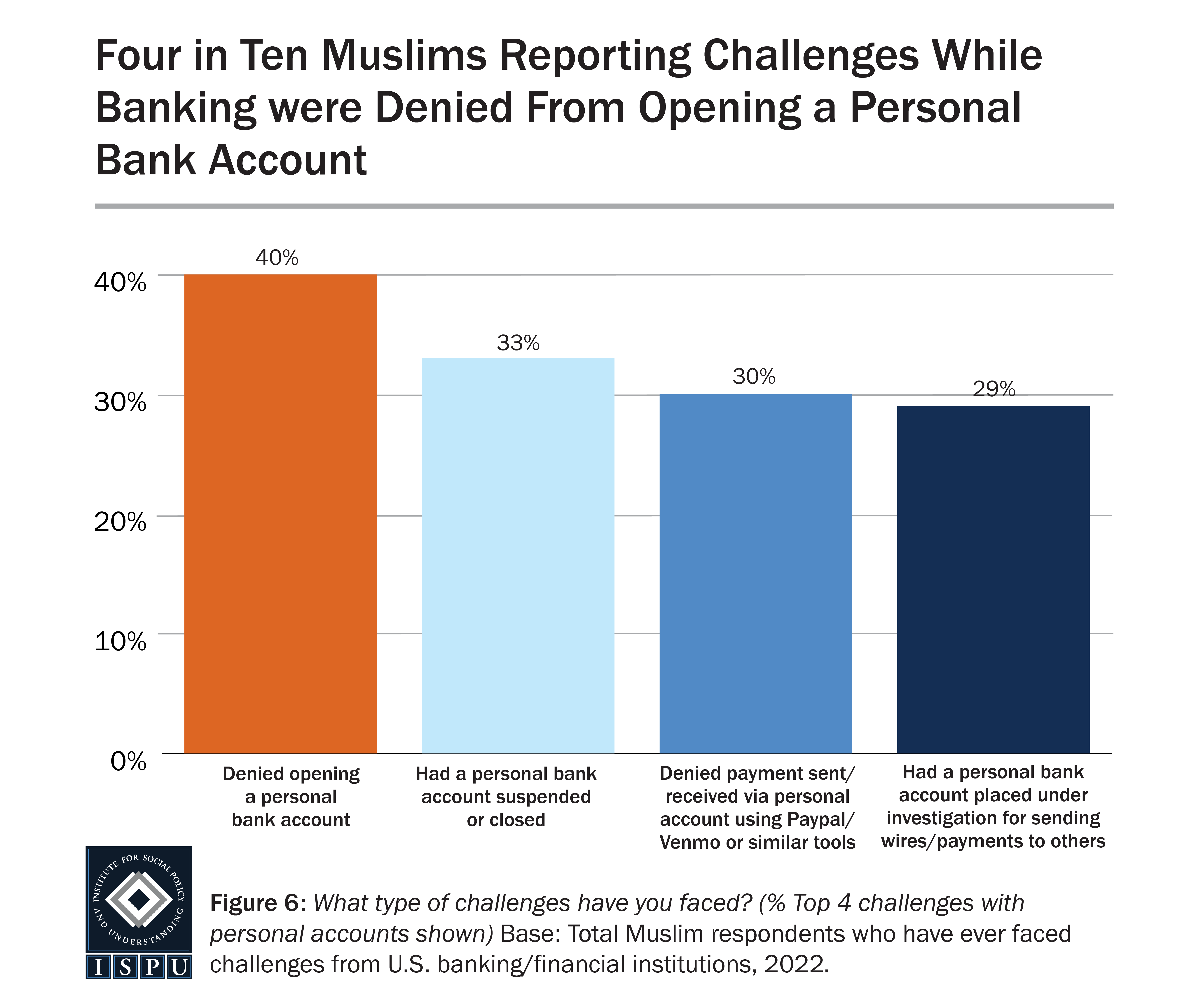

At 93%, nearly all Muslims who report facing challenges with financial institutions have faced a challenge with a personal account (this is on par with 88% of the general public). Among this group, the most common challenges include: 40% who were denied opening a new personal account, 33% who had a personal account suspended or closed, and 30% who were denied having payment sent/received via personal account using PayPal, Venmo, or similar payment apps. These findings are all on par with the general public. However, Muslims were more likely than the general public to have had a personal bank account placed under investigation for sending payments to others (29% vs. 14%).

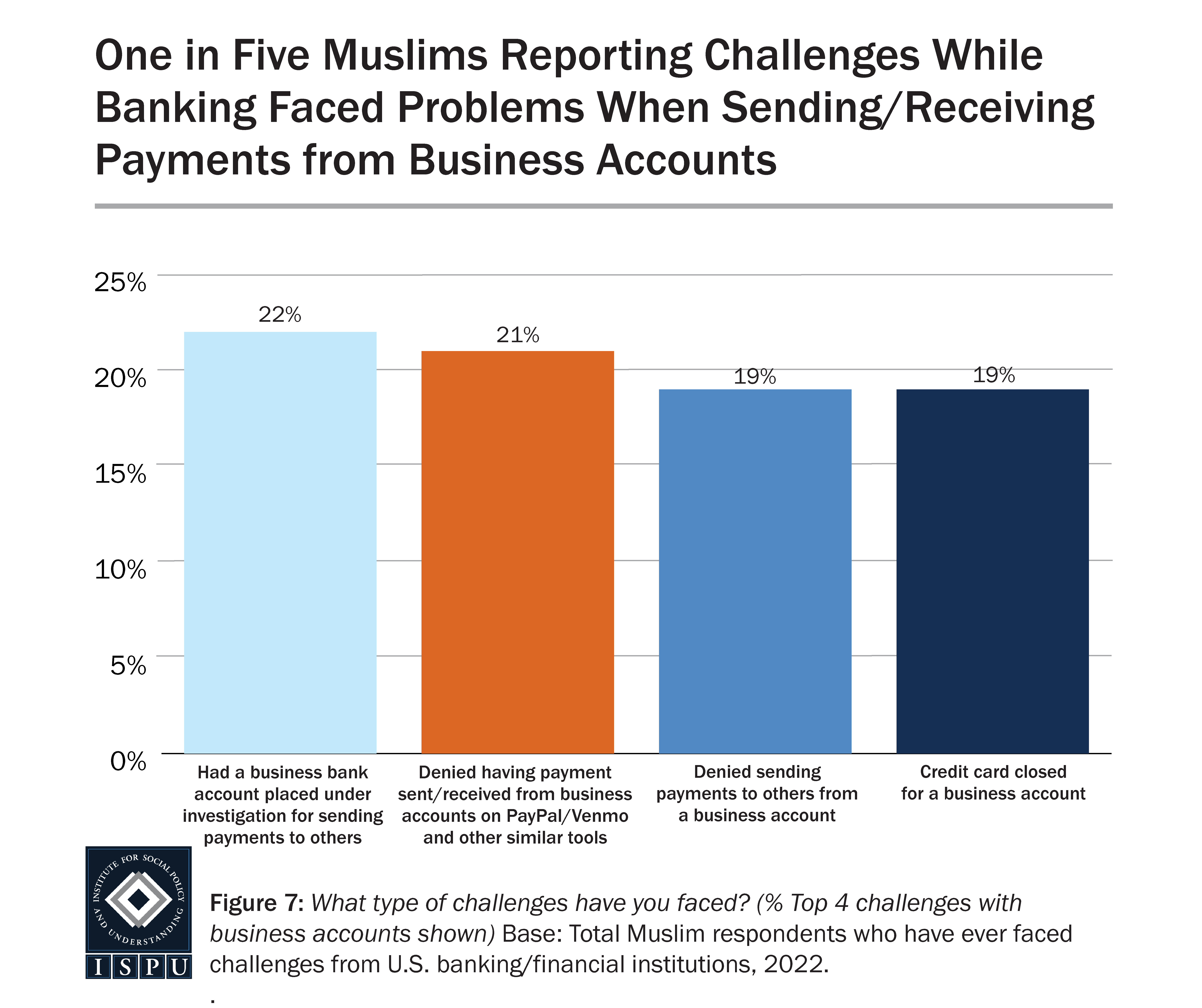

Among those who report challenges with financial institutions, Muslims (64%) are more than twice as likely as the general public (26%) to have difficulties with business accounts. The most commonly cited challenges Muslims² face with business accounts include: 22% who had a business bank account placed under investigation for sending payments to others, 21% who were denied having payment sent/received from business accounts on PayPal/Venmo and other similar tools, and 19% each who were denied sending payments to others from a business account and had a business credit card closed.

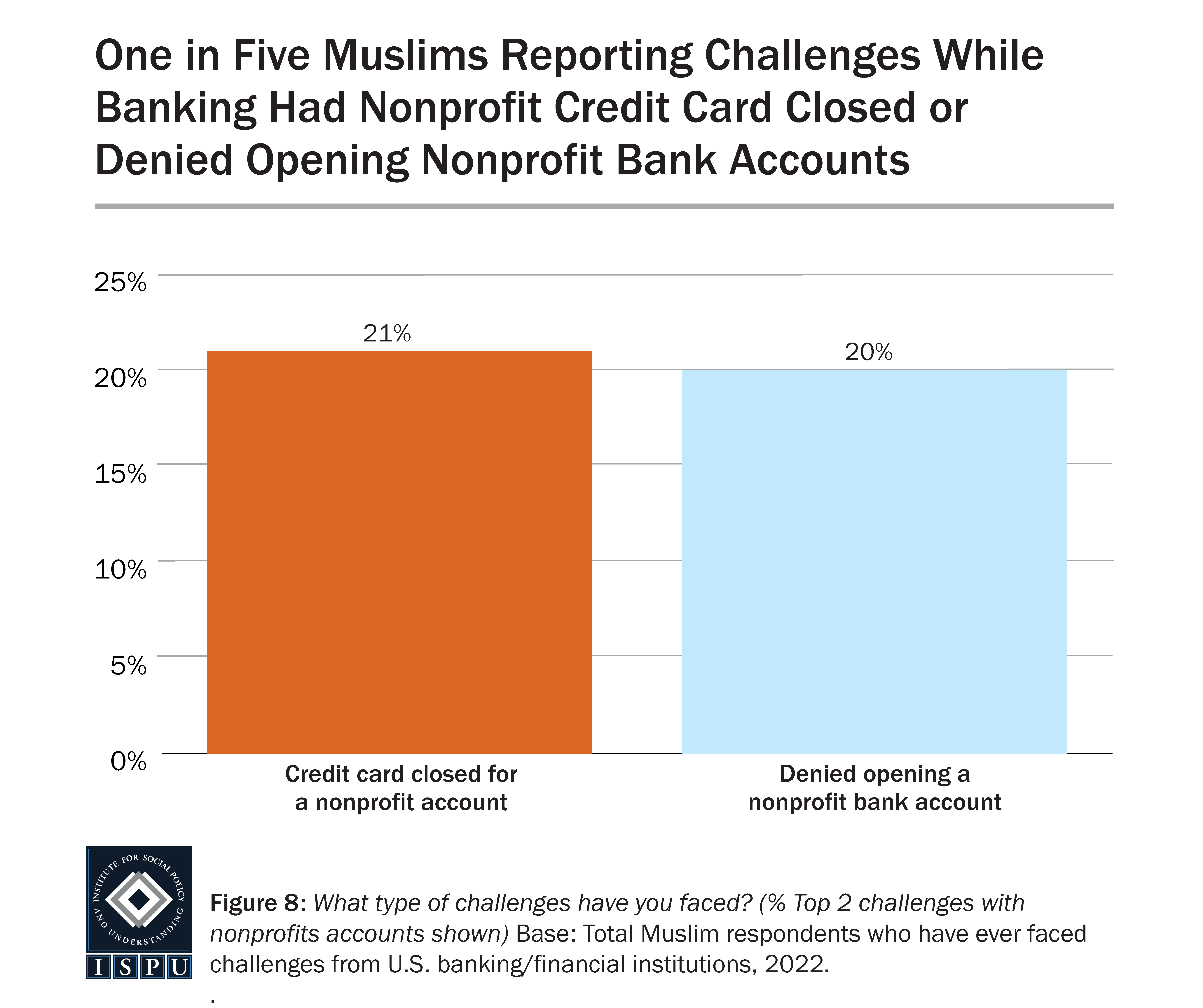

Among those who report challenges with financial institutions, Muslims are also more likely than the general public to face these challenges with nonprofit accounts (62% vs. 17%). Muslims who faced banking challenges with nonprofit accounts most often cited having a credit card closed for a nonprofit account (21%) and being denied opening a nonprofit bank account (20%)³.

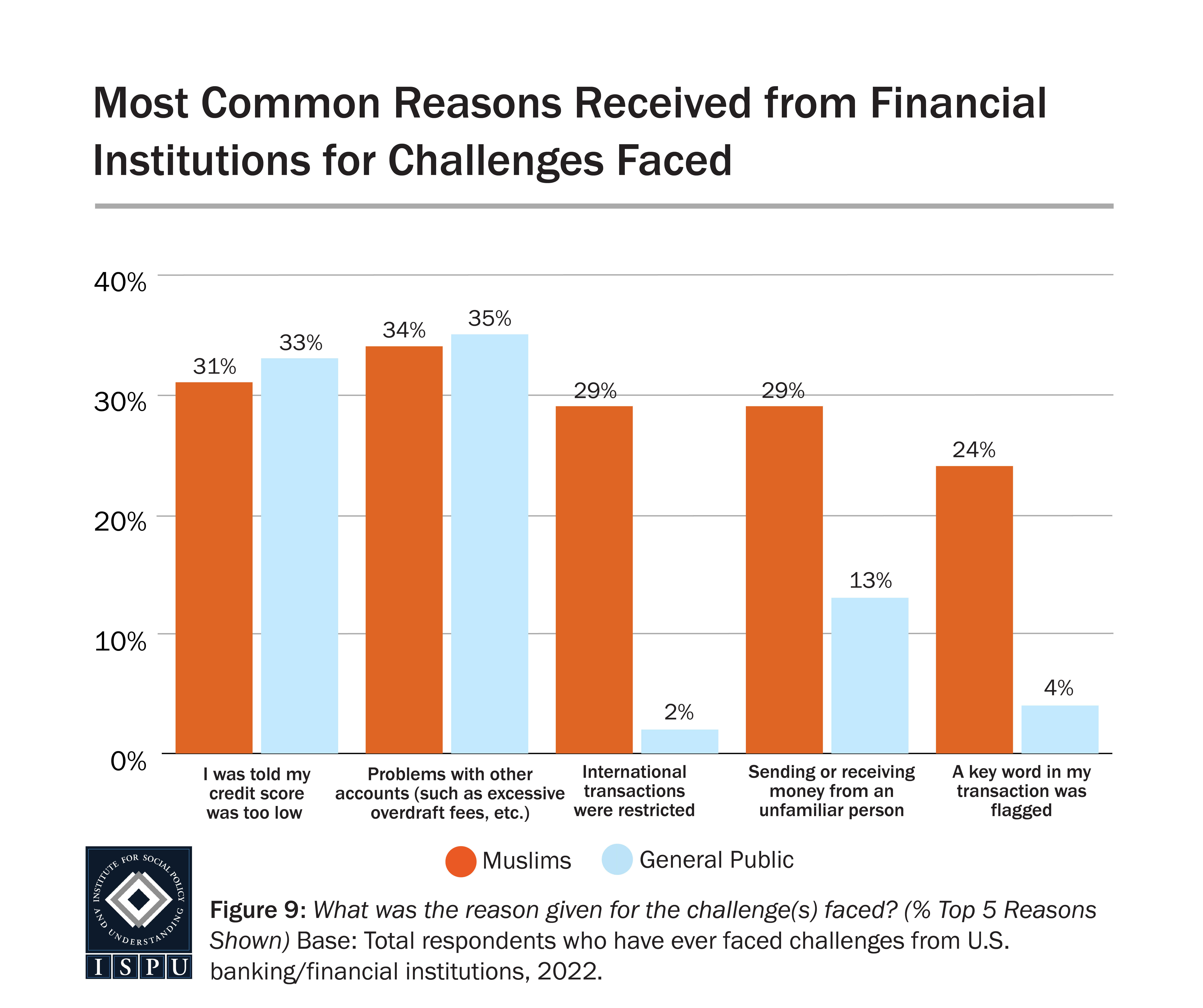

Most Often Reason Cited by Financial Institutions is Low Credit

In terms of the reasons financial institutions cited for the obstacles faced, about one in three (34%) Muslims who faced obstacles while banking (across personal, nonprofit, and business accounts) were told they had “problems with other accounts,” on par with the general public (35%). Twenty-nine percent were told that “international transactions were restricted” and that they were “sending or receiving money from an unfamiliar person,” both more likely than the general public (2% and 13%, respectively). At nearly 1 in 3, 31% of Muslim who faced banking challenges were “told my credit score is too low,” on par with 33% among the general public. The top three reasons do not indicate any differential standards, per se, although the noticeable proportion that mention restrictions on international transfers (29%) may point to a potential selection effect. That is, at least part of the heightened challenges Muslims report facing may be attributed to a higher propensity to engage in transactions that attract more overall scrutiny (regardless of the account holder). Finally, one quarter of Muslims (24%) who faced banking challenges were told a key word in their transaction was a red flag, compared with 4% of the general public.

Survey data on banking challenges seem to support the theory that financial institutions are disproportionately placing Muslims under suspicion and limiting account actions. These limitations can impact a community’s ability to run civic and charitable organizations, start and grow businesses, and access and grow its wealth. Banking is at the heart of what allows individuals and institutions to function and contribute. If it is indeed being systemically obstructed, this type of institutional discrimination risks disenfranchising an entire community economically and politically.

While the above analysis is far from dispositive, there appears to be more than enough preliminary evidence to warrant further investigation. Scholars studying the politics of race and ethnicity have developed unobtrusive ways to identify discriminatory practices beyond self-reporting and such methods can be similarly deployed in this case. In the meantime, policymakers and community leaders can turn to the snapshot provided here and start a constructive conversation on this pressing matter in order to better understand the obstacles minorities generally face when accessing the American financial system.

¹ Sample sizes for Latino Muslims are too small to report.

² Numbers for the general public cannot be reported due to small sample size.

³ Numbers for the general public cannot be reported due to small sample size.

ISPU would like to acknowledge LaunchGood and Islamic Relief USA for their support of this research.

Dr. Youssef Chouhoud is an assistant professor of political science at Christopher Newport University, where he is affiliated with the Reiff Center for Human Rights and Conflict Resolution. Youssef completed his PhD at the Political Science and International Relations program at the University of Southern California as a Provost’s Fellow. His research interests include political attitudes and behavior, survey methodology, and comparative democratization. Learn more about Youssef→